It’s time to start living on a budget that works for your family. Make smart financial choices to avoid getting into debt, cut down costs, save money, and stretch a paycheck without constantly taking loans. Quickly assess your financial situation, and create a family budget with our step-by-step guidelines.

Table of contents:

- What Is a Family Budget?

- What Does a Family Budget Include?

- Why Should You Have a Family Budget?

- What Is 50/30/20 a Percentage Rule?

- Making a Family Budget: Step-by-Step Instructions

- Simple and Free Budgeting Tools of 2022

- How Can a Family Get Some Money for an Emergency?

- Top 3 Ideas for Families to Save Money Every Day

- 4 Crucial Things You Should Not Be Saving Money On

- Basic Budgeting Tips Everyone Should Know

- Frequently Asked Questions (FAQ)

What Is a Family Budget?

Before we discuss how to budget, let’s give a definition to the term. A budget is a spending plan based on income and expenses. In other words, it’s an estimate of how much money you’ll make and spend over a specific length of time.

A family budget is a plan for your household’s incoming and outgoing funds over a specific time period, such as a month or year. The best family budgets are flexible, giving you breathing room to save more whenever you can.

According to statistics, only 32% of U.S. households prepare a monthly budget, and only half of them have this process become a habit. Many keep the budget “in mind” – about 26%.

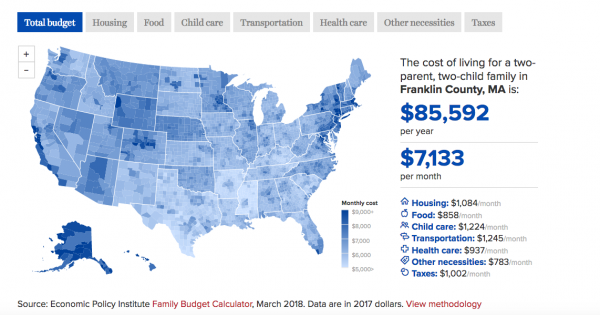

The average U.S. household spends over $70,000 on housing, groceries, transportation, health care and more. The map below shows the cost of living for a two-parent, two-child family in Franklin, MA:

What Does a Family Budget Include?

Income

Family or household income is the income shared by working people living in the same household. This also includes interest on deposits, odd jobs and freelancing, gifts for the holidays, pensions, social benefits and any other additional injections.

Expenses

An expense is the money spent by all family members. This part of the budget consists of several categories.

- General expenses. Meals, apartment bills, communication services, public transport, car maintenance (if everyone uses it), family vacations, loans.

- Unforeseen expenses. Breaking down plumbing or gadgets, getting medical attention, or other expenses that you can’t plan in advance.

- Personal expenses (for each family member separately). This includes buying clothes and shoes, having fun with friends, planned visits to the doctor, paying for college, buying gifts, paying for children’s clubs, spending on pets.

Before the beginning of the month, write down the approximate limits in each of the categories so that you do not accidentally spend more than you received.

Savings

Savings represents an individual’s unspent earnings. Savings may include:

- Emergency fund. Everyone needs it! These are funds that will save you in any financial difficulties: for example, they will help you purchase costly medicines – you know that getting sick can be really expensive in the U.S. Most experts believe you should have enough money in your emergency fund to cover at least 3 to 6 months’ worth of living expenses: for this, you can set aside 10% of income monthly.

- Money for big purchases. For example, a vacation, a car or a new home.

- Assets and valuable property. Investments, car, real estate – any value options. Such savings have bonuses – for example, investments can grow at the expense of interest and become sources of passive income.

Why Should You Have a Family Budget?

The need to make a family budget is not always obvious. Usually, people refuse to plan for two reasons. A person may have enough money for everything, and accounting for income and expenses seems like a waste of time. Or the person’s income is too low, and it is not possible to save, and therefore budgeting seems pointless.

In fact, financial planning does not depend on the income size. It is used for budgets of any size. Accounting for all expenses and earnings allows you to correctly organize the family budget. Here are the benefits of financial planning:

- Helps achieve large financial goals. If the income is not large enough to afford serious purchases at any time, the money has to be saved. For vacation, repair or car. To do this effectively, you need to budget;

- Helps create an emergency fund for unforeseen cases. Illness, job loss and other surprises always lead to additional expenses. Financial planning allows you to prepare for such cases by creating a “safety cushion”. This also includes the purchase of insurance.

- Helps to optimize expenses. Unplanned small purchases make up a large part of family spending. A lot of people look at the numbers in horror after the first month of budget analysis because they didn’t know how much money goes into all sorts of nonsense. Keeping records helps to find weaknesses and redistribute financial flows more competently.

- Helps reduce everyday stress. When you don’t know whether you will have enough finance from paycheck to paycheck, you are in constant anxiety. Unforeseen expenses force you to take loans or use credit cards. The statistics shows that the 2022 January demand for payday loans exceeded New Year’s eve! Then you have to think about how to repay the debt. This debt cycle creates constant stress, which eliminates competent planning. The family budget takes into account all expenses, so you don’t have to worry that the money will run out unexpectedly.

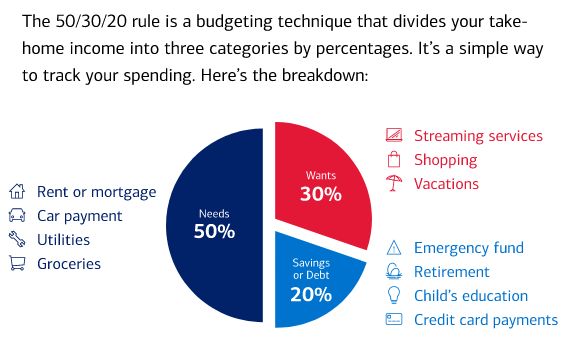

What Is 50/30/20 a Percentage Rule?

This is an intuitive way to keep a personal or family budget. All income is divided into three main groups: 50% goes towards your necessities, 30% towards leisure and fun, and 20% towards savings.

This ratio is not a dogma. The very creator of the rule, US Senator Elizabeth Warren, noticed: at least come up with your own proportions, but at least start watching money, and life will become better.

The essence of the budget is to see income and expenses, and then learn how to manage them. Ideally, you should manage money so as not to get into debt, be prepared for the surprises of life and slowly secure your future. The 50/30/20 percentage rule can help with all of these goals.

Making a Family Budget in 10 Steps

1. Choose a budget planning model

- General family budget. You pool your income, plan and pay your current expenses together. In this model, a significant drawback is the inability to arrange surprises for each other.

- Mixed family budget. Each pays an equal amount of money or the equivalent in percentage. In this case, it will be a significant disadvantage if one of the spouses gives the entire salary and the spouse does not have any funds left for personal needs. In this case, it can be agreed that you pay amounts proportional to your incomes.

- Separate family budget. You divide the total costs in half, spend the rest on yourself. There is a downside – when planning large purchases or trips, you need to agree on what contribution is required from each family member. Such a budget is easy to maintain when there are only two in the family, and incomes are about the same level.

2. Keep track of income, expenses and savings

You can write in a notepad or keep records in Excel, or you can use special apps (described below), the main thing is that your way of managing finances helps you, and does not create more confusion.

It’s convenient to manage your household budget in Excel. The categories usually include:

- Income: planned and unplanned.

- Mandatory payments: taxes, utilities, loans.

- Regular expenses: food, transportation, cosmetics.

- Education.

- Savings: emergency fund, pension, goal.

- Entertainment.

3. Plan your expenses

At the beginning of each month, plan your spending, calculate how much you are willing to spend on irregular expenses.

Agree on all irregular expenses when planning your home budget so that you do not take money from savings. It can be gifts for birthdays, corporate parties and joint trips to the cinema, theaters.

4. Build an emergency fund

First, create a financial safety cushion – it will help you in emergency situations – for example, if one of the family members suddenly falls ill or one of the spouses loses his/her job. Most financial experts recommend having three to six months’ worth of expenses available for emergencies.

5. Save at least 10% of income

Open a joint savings account (deposit) and set aside at least 10% of your income immediately after receiving your paycheck. So you save yourself from spending money for other purposes. You can start with a smaller amount. The most important thing is to make this action a habit.

Let’s say you make $1,500 per month, and your partner earns $1,000. Set aside 10% of your salary every month and you will save $3,000 at the end of the year.

6. Set up multiple savings accounts

This is necessary so that there are no illusions that you have saved an impressive amount and you use these funds all at the same time, for example, on vacation. It is better to open several deposits and save separately for education, save for a car or save for a mortgage.

The other important step is to start investing. Investing is passive income, you don’t have to do much to make your money work for you.

7. Reduce family expenses

After 2-3 months of accounting for expenses, you will start to get a picture of what you are spending your money on. Analyze your spending structure and think about what family money expenses can be reduced and what can be spent more on.

If you have long wanted to spend less on travel, go to bars or eat meat – the analysis will help you re-evaluate your expenses. You will find a few useful savings tips below on this page.

8. Create a joint account

You can open a joint account to jointly pay for utilities, buy groceries and household goods. This will help you always pay bills on time and your frige will not suddently become empty.

In addition, a joint account will free you from mutual settlements: you receive a paycheck, chip into the general budget, transfer 10% to a piggy bank account, and what is left is only yours.

9. Make a financial plan

If you make a financial plan for the next 3-6 months, then it will be easier for you to cope with upcoming expenses. Let’s say you need $2,000 for the New Year’s gifts.

If you save $400 a month, it will be easier for you to cope with the financial burden. Consider seasonality – when autumn approaches, expenses for schoolchildren increase, in winter – you need to buy warm clothes and shoes.

10. Involve your kids in budget planning

Budgeting for children is important for helping them learn financial literacy and develop good money habits. Teaching your kids the basics of budgeting can begin as early as age 10. Try it – it will benefit both you and your children. Research shows that if a child is taught financial basics in a playful way from childhood, in the future he or she will manage spending better. To convey these important thoughts, pay attention to the books “A Dog Named Money” by Bodo Schaefer and “If You Made a Million” by David M Schwartz, the cartoons “Dora the Explorer” and “Phineas and Ferb”.

Simple and Free Budgeting Tools of 2022

Many banks today offer customers various services that help manage their expenses. For example, using online banking allows you to track income and expenses by sending SMS messages. Thus, you will keep the history of payments, even the smallest ones. Some banks have a service that allows you to automatically transfer part of the funds to the so-called piggy bank. This is a separate account designed to accumulate savings.

In addition, there are many tamplates and apps that help you keep track of your funds. They will help set a spending limit for a day/week/month, plan large purchases, set aside certain amounts from paychecks and other sources of income, keep track of spending, etc.

The Federal Trade Commission has a website to educate consumers about finances, including how make a budget. To get started, consult its “Make a Budget” worksheet. Download the free household budget worksheet PDF and fill in the empty fields to find out whether you’re earning more than you spend or spending more than you earn.

Another popular option is using an Excel template from Office. Family budget templates include a household expense budget, holiday budget planner and event budget.

You can also sign in at google.com/sheets, then browse the household monthly budget template gallery.

Make it easier to manage a household budget with an easy budget tracker from Mint. Instead of manually writing down and accounting for each transaction on a regular basis, intuitive software creates running totals, tracks fixed expenses, highlights discretionary spending, makes suggestions, and shows how debits and credits influence each other for your bottom line. Go here to download the iOS mobile app. The app is also available to download on Google Play

Or try an app like Mvelopes. It is a personal finance app and website that bring an updated twist to the classic cash envelope budgeting method. Its envelope budget system can help you reduce your spending by up to 35%. The Mvelopes Mobile apps is avialable for iOS and Android phones and tablets.

There’s also You Need A Budget (YNAB), which will helps you take control of your money today with their 30-day free trial and their proven method for budgeting your money. The YNAB app is offered in both the App Store (for iOS) and on Google Play (for Android).

The EPI’s Family Budget Calculator determines how much money a family needs to attain a modest but decent living level. The tool takes into account geographic differences in cost of living and factors in a broader range of expenses—including housing and food.

The Honeydue is one of the best family budget apps designed specifically for couples. It is available in the iOS App Store and Google Play.

You can also download the The Free Budget Planner spreadsheet where you can detail all your income and outgoings.

Modern banking tools, household budget calculators, monthly household budget templates and mobile apps also help a lot. They immediately display all your purchases: it is possible to track what money is spent on and optimize expenses. This is a very convenient and visual way to keep track of important transactions.

How Can a Family Get Some Money for an Emergency?

Of course, it is far from always possible to live according to a plan, and suddenly going beyond the budget (especially a small one) is as easy as shelling pears. To avoid stressful situations, you can use a credit card with an interest-free grace period for your benefit. It is optimal if the available limit on it does not exceed your family income by more than 1.5 times.

You can only pay with this card, and by the end of the month you will have a complete report in front of your eyes: what exactly you bought and how much you spent on it. At the same time, keep your income (salary, money for part-time jobs, bonuses, etc.) either on a separate card or in cash. When it’s time to cover your credit card, you won’t have a question about where to get the money: it’s already been set aside.

Of course, using a credit card requires serious self-control and a stable source of income. It is often easier to take a payday loan from a place like wmfcu.org. With it, you can cover the balance on a credit card and receive financial support when the family budget is close to zero. A payday loan provides an opportunity to borrow $100-$1,000 for up to 30 days. At the same time, you do not need to go anywhere to apply for a loan and receive money: the application is made online, and the money is transferred to your bank account shortly after approval

Top 3 Ideas for Families to Save Money Every Day

- Make a grocery list for the week. On the weekend, make a joint purchase of the necessary grocery basket. Stick to the list when you go shopping. If it is not possible to go shopping together, divide the shopping responsibilities, roughly calculating how much you will have to spend.

- Cook at home. It is cheaper than eating in cafes and restaurants, and even more useful. Make a stockpile of ready-to-cook food: cut the beef into stew, grate the carrots for sautéing into the soup, boil the broth pot and pour it into containers. All this is perfectly stored in the freezer, and at the right time you can simply defrost it and use it for its intended purpose. This will be a significant time and money saver.

- Follow promotions and discounts. At the end of the season, large retail chains usually make big discounts, online stores arrange promotions. Planning your purchases in advance will also help here. Read this this wikiHow guide on how to get Amazon promotional codes.

Below is a video from Gabe Bult who shares his experience on how he saved $10,000 in one year!

4 Crucial Things You Should Not Be Saving Money On

The task of the family budget is to optimize income and expenses, and not to keep as much money intact as possible. Therefore, you should not deny yourself everything. Below is a list of mistakes to avoid when saving money:

- Saving on health. The disease can progress over time, and treatment can only become more expensive.

- Not paying bills. Missing one month is not scary, but then interest will start to incure, and if you stop paying your utility bills, water or electricity can be turned off.

- Buying cheap clothes and shoes. If a thing is of poor quality, does not fit into your wardrobe, or you don’t like it at all, it will quickly go to a landfill or gather dust in a closet. It’s better to pay extra for the quality.

- Depriving yourself of all entertainment. Saving on vacation can lead to accumulated fatigue. And in this state it is very difficult to save the resource. In addition, there is a risk to break loose at some point and spend all the savings on entertainment.

Basic Budgeting Tips Everyone Should Know

- The right attitude to planning. You need to be aware of why you need to plan a family budget. Perhaps you’ve decided to save up for new furniture or renovations. This will be an incentive for the rational distribution of funds.

- Fewer details. Do not complicate the records of income and expenses with unnecessary details. Items of income and expenses should be short and to the point. You should not spend too much time on this process so that budget planning does not become a burden to you.

- Reduce large expenses. It is better to reduce large expenses than to save on insignificant ones, or deny yourself the most necessary. You should analyze large items of expenditure and reduce them a little.

- Open a deposit. To make large savings for the future, you can open a deposit with replenishment and put all deductions that you want to make in advance into a bank account.

- Set realistic goals. When starting to plan a budget, you need to pursue some real goal in the near future, and not make far-reaching plans that will turn out to be impossible.

- Flexible approach. Over time, the family budget may change (you may find new sources of income, your wages will increase, a new family member will be born). Do not be afraid to review the amounts of income and expenses from time to time.

Watch a video to learn some more budgeting tips for beginners:

Frequently Asked Questions (FAQ)

Which expenses should you consider when creating a family budget?

When making a family budget, it’s important to include all your expenses—the essentials and the entertainment. Essentials include rent payments, groceries, phone and internet, transportation and car costs, utilities, childcare expenses, health and other insurance costs, and taxes. Don’t forget leisure and fun expenses, including eating out, shopping, and vacations.

What are the best budgeting books to read?

We recommend that you read at least one of these expert-recommended budgeting books: “The One Week Budget” by Tiffany Aliche (The Budgetnista), “Spend Well, Live Rich” by Michelle Singletary, “The One-Page Financial Plan” by Carl Richards, “How to Manage Your Money When You Don’t Have Any” by Erik Wecks, “You Need A Budget” by Jesse Mecham, “Broke Millennial” by Erin Lowry, “The Automatic Millionaire” by David Bach.

Should you share your family budget with your kids?

One of the best ways to teach your children about the value of saving is to involve them in the family budget. This will help your kids develop healthy spending habits and learn the concept of money early. From a young age, talk openly with your children about money and make sure they become part of your spending choices.

What is the first step in creating a family budget?

First, you’ll need to determine your household income after-tax, so that you have an idea what’s coming in each month. Start a budgeting spreadsheet and create a list of household expenses. Then, compare your monthly net income to your total expenditures and choose a realistic budgeting plan that works for you and your family. Finally, identify where to make some savings and automate them.